TRICOR Insurance has earned the distinction of “Top 100 largest insurance brokers in the United States”, as published by Business Insurance, a leading business publication to the insurance industry. The 2018 rankings are based on 2017 revenue generated by U.S. based clients. TRICOR ranked 99th overall in the Top 100 selected from more than 30,000 insurance agencies in the United States.

Every construction site needs a Severe Weather preparedness plan to ensure a safe environment during hazardous weather. Having a written Emergency Action Plan (EAP) is also an OSHA requirement.

Every construction site needs a Severe Weather preparedness plan to ensure a safe environment during hazardous weather. Having a written Emergency Action Plan (EAP) is also an OSHA requirement.

In the Midwest there are two things that nearly everyone loves about summer—enjoying the warm weather and grilling. In fact, July is peak grilling season followed closely by May, June and August. I’m sure we all can agree there’s nothing better than the smell of food like burgers, salmon and ribs cooking on a grill.

To most people, when they hear the word “audit” they immediately have unpleasant thoughts and want to throw out both hands and scream “NOOOOO”. Many people associate audits with taxes and the big, bad IRS and usually nothing good can come from this experience. But not all audits are bad!

Perhaps your business owns, operates, maintains or uses mobile equipment in some way or another. Many times, there is confusion as to what is actually considered “mobile equipment,” and does it differ from an “auto.”

Perhaps your business owns, operates, maintains or uses mobile equipment in some way or another. Many times, there is confusion as to what is actually considered “mobile equipment,” and does it differ from an “auto.”

First, let’s start off by understanding what “mobile equipment” is and what an “auto” is, since the two are often lumped together within the insurance universe.

For home or rental property owners, freezing pipes are a big concern during the cold winter months. The pipes most at risk are exposed pipes in unheated areas of the home, pipes located on exterior walls, and any plumbing on the exterior of the home. Here are our top fours tips for making sure your pipes won’t freeze this winter.

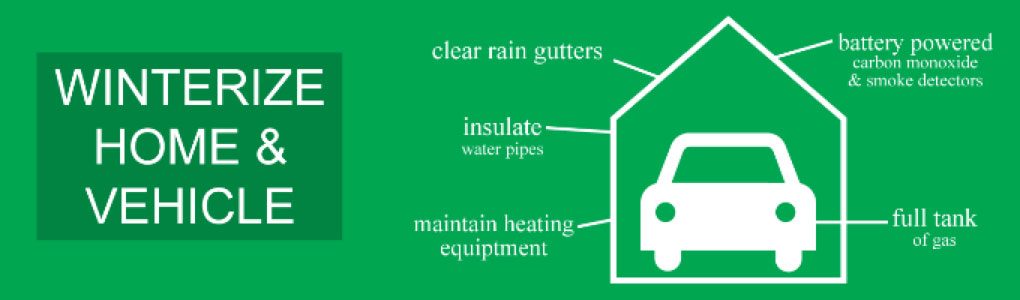

Winterize Your Home and Vehicle

We can’t always avoid winter storms, but we can take precautions to be prepared for the unexpected and recover with as little damage as possible. Things such as winterizing your home and vehicle are some of the best ways to reduce damage.

As the leaves start changing color and the weather starts cooling down, it can only mean one thing; fall is here. When we think of fall, pumpkins, sweaters and corn mazes all come to mind. And with so many activities and so little time, it’s easy to forget that fall is a time to be thankful. With the holidays approaching, there is no better time than now to start getting into the holiday spirit!

Workers compensation can be a large expense for small businesses. It’s not uncommon for small business owners, especially new business owners, to exclude themselves from coverage on their own company’s workers’ compensation policy to reduce the expense. The assumption is that their health insurance will cover any injuries they suffer while working. The truth is that most health insurance policies do not cover work related injuries. The benefit for lost wages provided by a workers compensation policy is often overlooked during this cost/benefit analysis. Most disability policies also exclude work related disability as well. Can you afford to go without health insurance and disability insurance when you are most at risk?

How best to protect and make their property as “marketable as possible” to the insurance carriers who underwrite their coverage.

How best to protect and make their property as “marketable as possible” to the insurance carriers who underwrite their coverage.